The British customs authority HMRC recently announced new requirements for Intrastat declarations. From 1 January 2021, registered Intrastat businesses will have to submit Intrastat declarations if they exceed the Intrastat exemption threshold in the coming year.

New requirements for Intrastat declarations

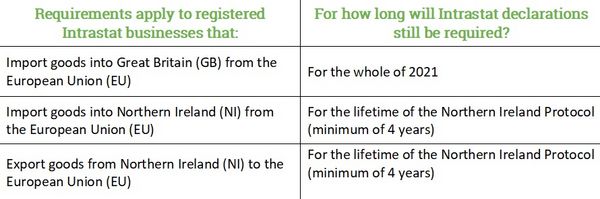

The new requirements apply to registered Intrastat businesses that trade between GB-EU and NI-EU, regardless of whether they are resident in the UK or not. Companies will have to submit Intrastat declarations if they are importing goods into GB or NI from the EU or if they are exporting from NI to the EU.

When do the requirements apply and for how long will Intrastat declarations be required?

- Import of goods into Great Britain (GB) from the European Union (EU) - For the whole of 2021

- Import of goods into Northern Ireland (NI) from the European Union (EU) - For the lifetime of the Northern Ireland Protocol (minimum of 4 years)

- Export of goods from Northern Ireland (NI) to the European Union (EU) - For the lifetime of the Northern Ireland Protocol (minimum of 4 years)

Please note that you do not have to submit Intrastat declarations for goods exported from GB to the EU! HMRC will collect all GB export trade statistics directly from export customs declarations as the single source.

Furthermore, there are no Intrastat requirements for the movement of goods between GB and NI.

Intrastat exemption thresholds

Intrastat declarations should be submitted if it exceeds the following exemption thresholds for arrivals and dispatches:

- £1,500,000 for EU to GB and EU to NI imports (arrivals)

- £250,000 for NI to EU exports (dispatches)

Please note that if the trade value increases above thresholds in 2021, companies will have to submit Intrastat declarations.

Submission of customs declarations and Intrastat declarations from 1 January 2021

In order to fully prepare for the new border controls for EU goods after the Brexit transition, customs import controls will be introduced in stages from 1 January 2021. As part of these staged controls, businesses importing non-controlled goods from the EU to GB can delay the submission of the customs declaration for up to 6 months.

Delaying the submission of customs declarations means that the data from such declarations would be unavailable which leads to gaps in the trade statistics for imports into GB. To avoid this, monthly Intrastat arrivals declarations will continue to be required during 2021!

Where can I find more information about the Intrastat requirements?

Detailed information about the new Intrastat requirements can be derived from authorities like the HMRC: https://www.gov.uk/government/publications/notice-60-intrastat-general-guide/notice-60-intrastat-general-guide

However, if you have further questions about the new regulations we are more than eager to discuss it with you - simply contact us via [email protected].

Otherwise watch out for updates on this in one of our future newsletters!