As of October 1, phase 1 of the CO2 border adjustment levy or CBAM (Carbon Border Adjustment Mechanism), the EU's pioneering instrument against carbon leakage, came into force.

During the transition phase, the CBAM applies only to imports of cement, iron, steel, aluminum, fertilizers, electricity and hydrogen. EU importers of these goods are required to report the volume of their imports and the greenhouse gas emissions generated during production, but they are not required to make financial payments during this phase. Importers are required to collect data for the fourth quarter of 2023, but the final report is not due until January 31, 2024.

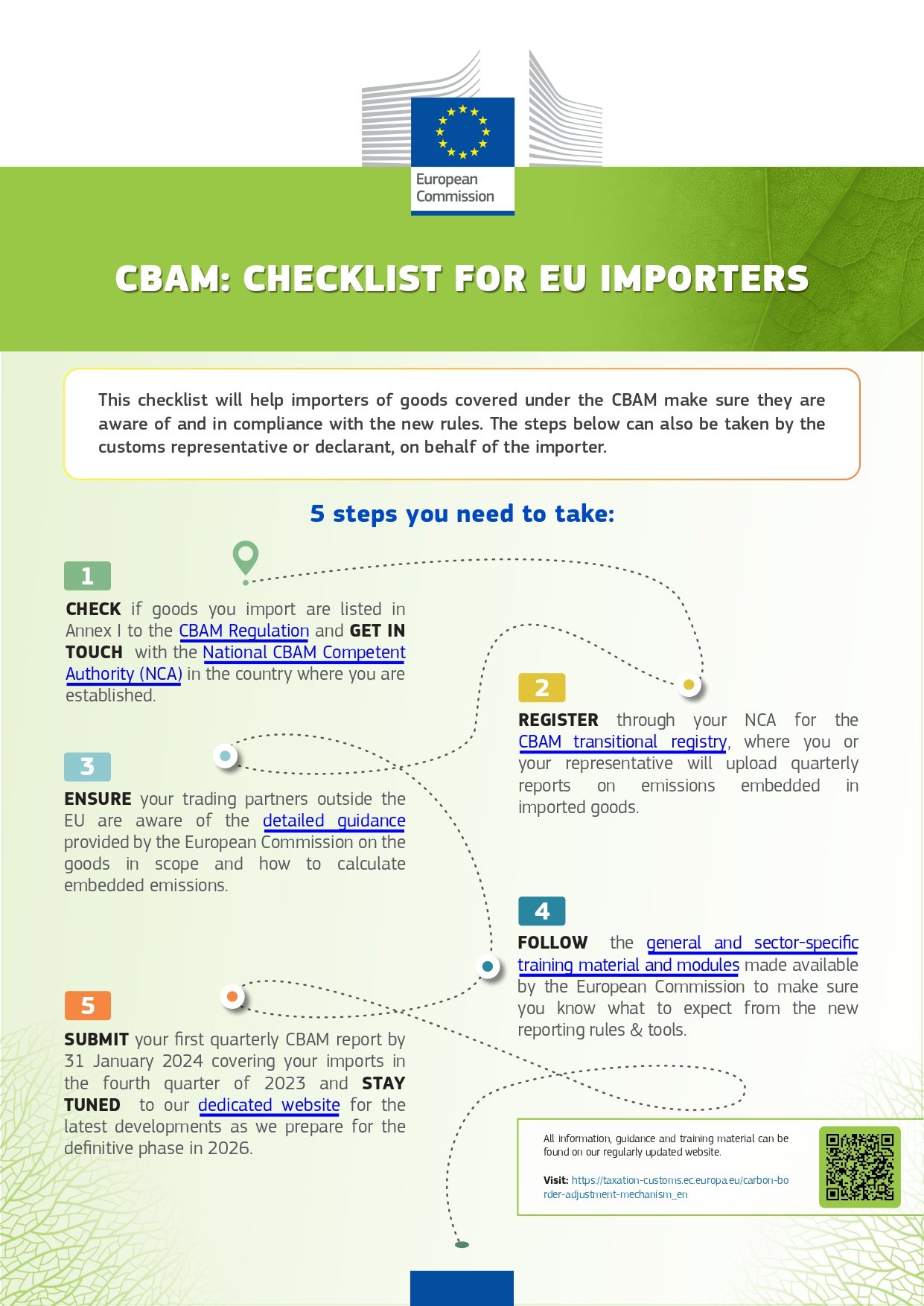

The CBAM implementing regulation published in August is quite complex. Many companies first have to familiarize themselves with the regulations in detail and distribute the tasks correctly internally. To help EU importers with the practical implementation of the new regulations, a new CBAM Transitional Register has been available since October 1 which helps importers make and report these calculations. To further assist companies, the EU Commission is providing step-by-step instructions, online training materials and webinars as well as specific factsheets.

Read our White Paper on CBAM requirements and how MIC software-modules can help organizations comply with these regulations in the future. Just fill out the form and you will immediately gain access to our latest White Papers.

Checklist for EU Importers provided by the EU Commission: