Besides the decisions for a fully electronic customs declaration of all consignments (from 1.7.2021) and the advanced transport notification of all consignments of goods from third countries prior to shipment (phased approach of ICS2 from 15.3.2021 onwards, for more details please see our latest news), the European Commission has also decided for new regulations referring to the import VAT exemption limit for low value consignments.

The EU decided to remove the import VAT exemption limit (de-minimis) on low value goods as of 1.7.2021. This concerns the abolition of VAT de-minimis for goods ≤ € 10/22. While now goods valued ≤ € 10/22 are exempt from VAT, import VAT will be applicable from 1.7.2021. However, low valued goods will still be exempt from customs duties with beginning of July 2021. In contrast to that, import VAT and customs duties for goods > € 10/22 and ≤ € 150 remain the same after 1.7.2021. This means that import VAT will be applicable on all imported goods valued below € 150.

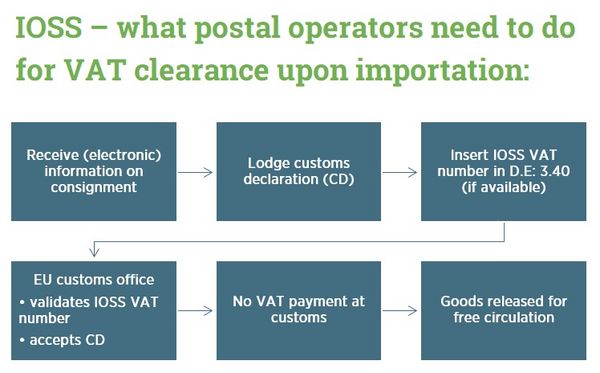

One of the simplification measures (for suppliers) that comes with the new regulations is the import One Stop Shop, which can be used when consignments are sent directly from outside the EU to end-consumers in an EU member state. The supplier will be granted a so-called I-OSS VAT identification number. Under this scheme, the supplier needs to charge VAT on sales to end-consumers. VAT must be paid as soon as the low value goods are released for free circulation. The whole process can be seen in the figure below.

Basically, the EU aims to prevent inequalities, as currently companies in the EU are not treated equally, compared to those from outside the EU who are exempt from VAT regarding low value consignments. Therefore, these measures are designed to prevent the circumvention of import VAT and customs duties on goods imported into the EU.

More information about the regulations can be derived from authorities like the EU commission:

- COUNCIL DIRECTIVE (EU) 2017/2455 of 5 December 2017 amending Directive 2006/112/EC and Directive 2009/132/EC as regards certain value added tax obligations for supplies of services and distance sales of goods

- COMMISSION DELEGATED REGULATION (EU) 2019/1143 of 14 March 2019 amending Delegated Regulation (EU) 2015/2446 as regards the declaration of certain low-value consignments

About MIC:

MIC is the world leader in providing global customs and trade compliance software solutions. The MIC group currently employs 400+ professionals around the world. More than 700 international customers rely on MIC software products for their global customs and trade compliance management solutions.

For more information about MIC and how we could help your operations, please contact us via [email protected].